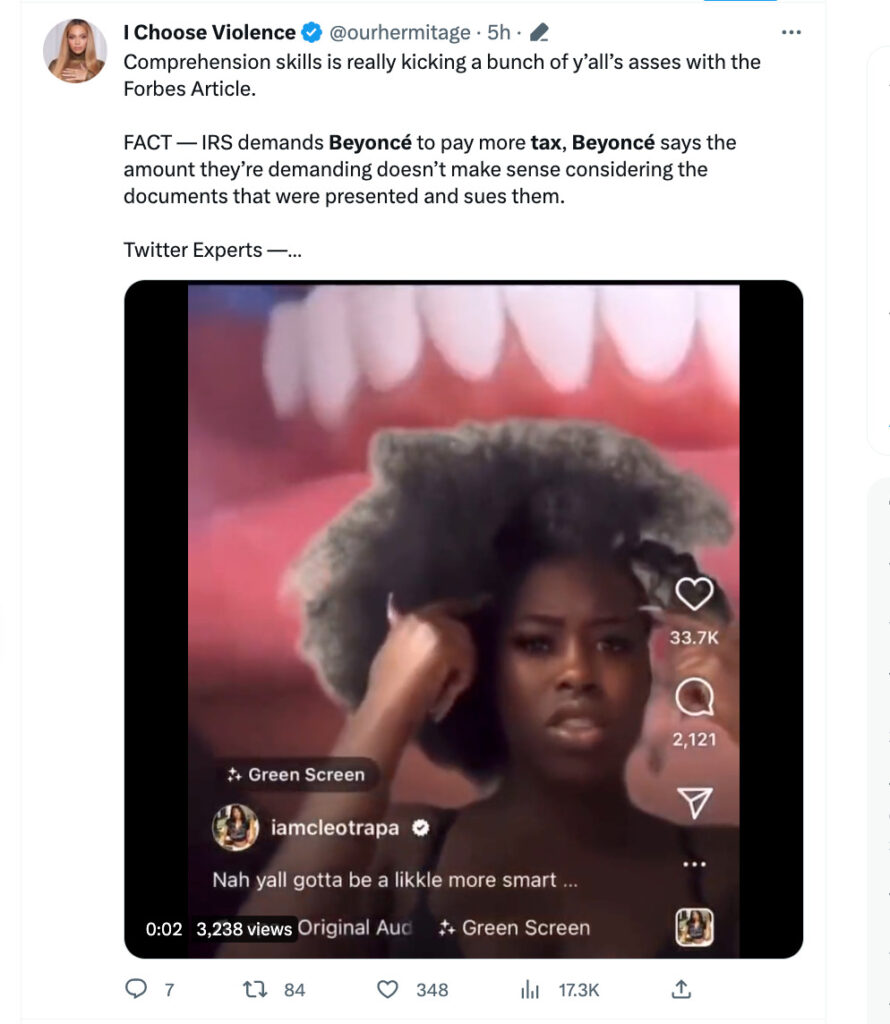

Beyonce is going to challenge a $2.7 million Tax Liability Notice by the IRS in court.

A petition filed by the singer on April 17 via her attorney holds that the IRS has inaccurately determined her tax liabilities from her 2018 and 2019 tax returns. The petition seeks a redetermination of her taxes and penalties alleged by the IRS.

According to the Notice of Deficiency given by the IRS to Beyoncé, she owes $805,850 for 2018 and $1,442,747 for 2019, plus an additional $449,719.40 in penalties for those years.

Beyonce’s petition holds that a charity contribution worth $868,766 has also been erroneously held against her.

As per reports, Beyonce who is married to the rapper Jay-Z (Sean Carter) has filed the review petition as a single taxpayer. She has not included her husband in the filing.

Beyonce’s net worth is estimated to be $500 million.

She founded the charity organization BeyGOOD in 2013. The website of BeyGOOD states that it aims to achieve “economic equity by supporting organizations that serve marginalized and underserved communities with educational scholarships, internships that lead to job placement, and entrepreneurship support for business sustainability.”

Join the Community and Be a Part of the Conversation

You must be logged in or registered to post a comment.